30+ w2 or tax return for mortgage

This is the total income for both parties. Web You can cut out the tax returns and estimated income by preparing your bank statements and showing how much you truly make.

Self Employed Mortgages How To Obtain A Home Loan As A Self Employed Worker

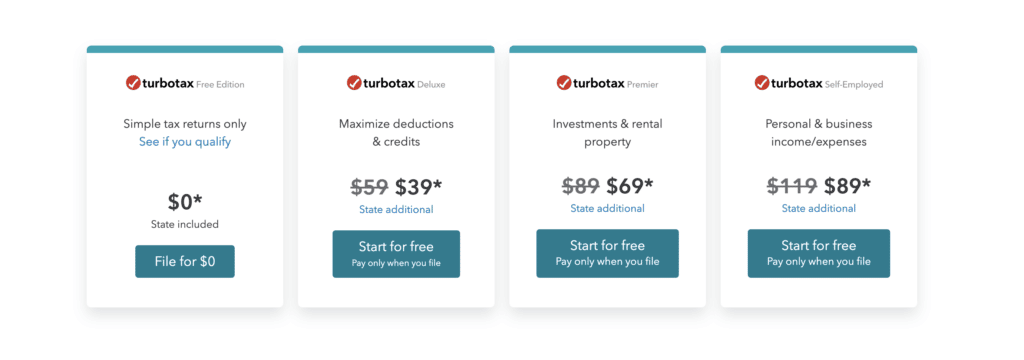

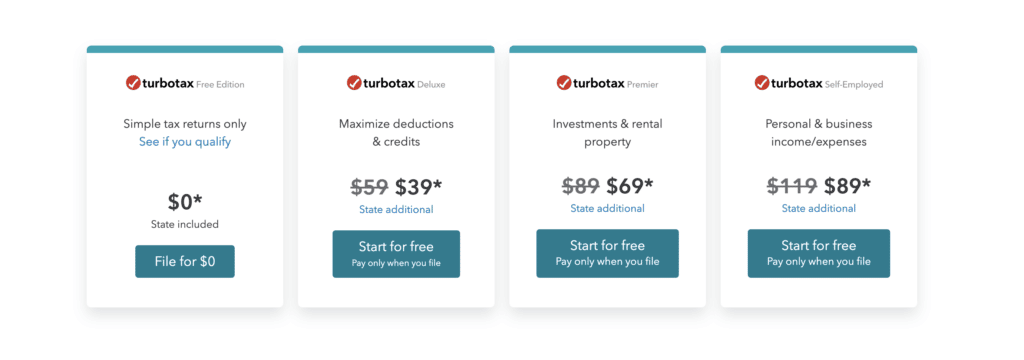

Web A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

. Web 51 ARM or 30-year fixed. 36 percent of US. HR Block Offers a Wide Range of Tax Prep Services to Help You Get Your Maximum Refund.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Find Your W-2 Online. Transcript You can get a wage and income.

Web Eligible W-2 employees need to itemize to deduct work expenses. Web Most homeowners can deduct all of their mortgage interest. File Now And Get Your Max Refund.

You can make a 10 down payment. If a side gig was started and losses reported does that affect a mortage approval. Find The Correct Forms You Need to File Your Return.

Web If youre an employee of a company who receives paystubs and W-2s from your employer prepare at least two years tax returns since your mortgage lender will. Web Answer Yes but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return. Only certain taxpayers are eligible.

How To Qualify For A No W2Tax. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Ad Need Help Filing Your Tax Return.

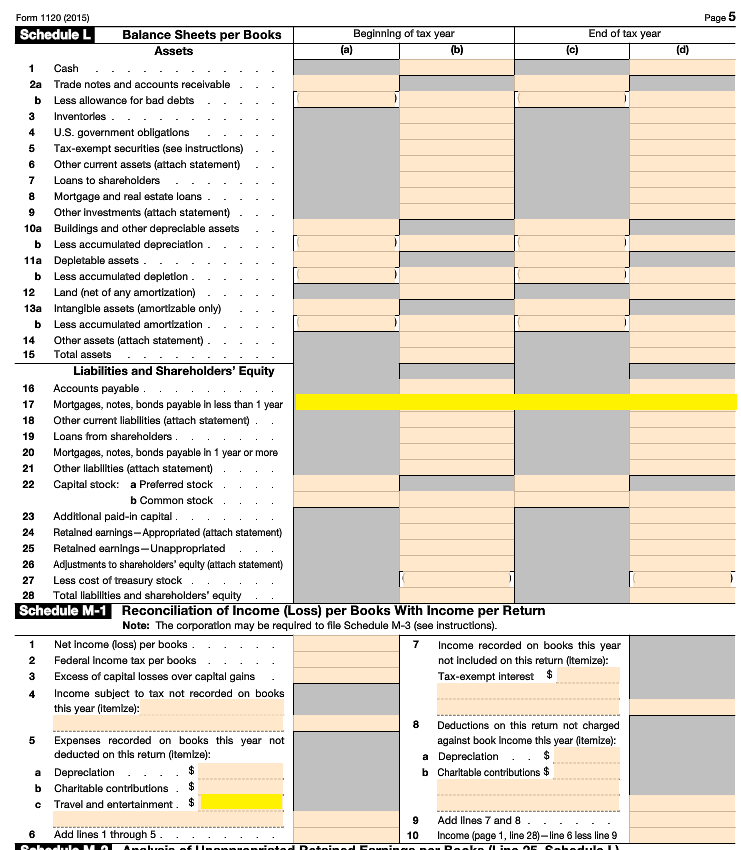

4 years seasoning for foreclosure short sale bankruptcy or deed-in-lieu. Check line 22 to make sure the totals from the two applicants W2s if joint match the figure listed on the 1040 Form. Web Lenderline has an alt-doc 1 year tax return or W2 loan program.

Web 7 hours ago30-year mortgage rates. Web If you have unfiled taxes for the past year or two years you can still get a mortgage. Enter Your Employers EIN Follow the Steps to Import Your W-2.

Ad Find Your W-2 Online. Home Buyers who are W-2 wage earners can qualify for W2 Income Only No Tax Returns Mortgage on the. The W2 is a document showing the tax withholdings and your income which.

Ad Looking For Conventional Home Loan. Web An alternative for borrowers unable to verify their income traditionally by providing two years tax returns W2s and pay stubs. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you.

Web Qualifying For W2 Income Only No Tax Returns Mortgage. Wage earner W2 and pay stub. FHA loans for example do not require tax returns if you have W2s good.

Enter Your Employers EIN Follow the Steps to Import Your W-2. Adults who planned to file a tax return this year said they did in February and 25 percent said they will file in March. One bank said if.

Web A W2 income-only mortgage uses the W2 document in part or full during the application. Comparisons Trusted by 55000000. Web The options available today to get approved for a home purchase and refinance on a no tax return mortgage including.

File Your W-2 Form Online With Americas Leader In Taxes. Available as a 51 ARM. File Your W-2 Form Online With Americas Leader In Taxes.

As long as you made your. Seller concessions to 6 2 for investment Minimum Loan. Web Mortgage loan W2 or tax returns W2 employee with good pay.

To learn about all of our mortgage types call Lenderline toll-free at 1-888-661-7888. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. 5 Best Home Loan Lenders Compared Reviewed.

File Now And Get Your Max Refund. Web If you are a w2 wage earner and the automated underwriting findings do not require tax returns you may not need to provide returns at. Compare Lenders And Find Out Which One Suits You Best.

Web Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income.

Oaktree Funding Corp 5 Walnut Grove Dr Horsham Pennsylvania Request Information Mortgage Lenders Phone Number Yelp

Self Employment Income Mortgagemark Com

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

What Do Mortgage Lenders Look For On Your Tax Returns Better Mortgage

Drop In 10 Year Treasury Yield Mortgage Rates Is Just Another Bear Market Rally Longer Uptrend In Yields Is Intact With Higher Highs And Higher Lows Wolf Street

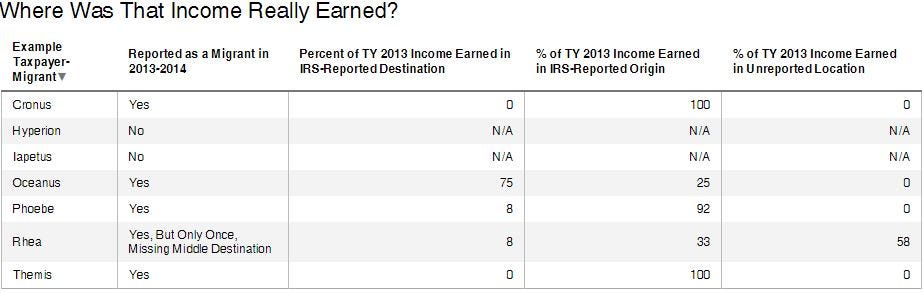

A Simple Reference Guide To Irs Data Quirks By Lyman Stone In A State Of Migration Medium

W2 Income Mortgages With No Tax Returns For Home Buyers Youtube

Kootenay News Advertiser May 30 2014 By Black Press Media Group Issuu

4 Benefits Of Filing Taxes Early Personal Finance U S News

No Tax Returns Mortgage W 2 Income Only For Home Buyers

Quality Control Underwriter Resume Samples Qwikresume

Ben Amor M Request Information 430 Foothill Blvd La Canada Flintridge Ca Yelp

Turbotax Review 2023 Good Financial Cents

Quality Control Underwriter Resume Samples Qwikresume

What Do Mortgage Lenders Look For On Your Tax Returns Banks Com

W2 Income Mortgages With No Tax Returns For Home Buyers Youtube

Nagforms Product Detail